The “green premium” is the additional cost for a product or a service that does not emit greenhouse gases. While there is no single, universal number, extensive research shows a clear and consistent financial premium for buildings with recognized green certificates.

The range of green premium can vary significantly based on the local market, building type, and the level of certification.

Based on multiple market studies, there are two typical ranges for the green premium:

“Sales Value Premium”: Certified green buildings often sell for 5% to 20% more than comparable non-certified buildings. Some analyses have found that this number can be even higher in specific markets.

“Rental Rate Premium”: Green buildings consistently achieve higher rental incomes, with numbers typically ranging from 3% to 12%. In some European markets, this premium has been observed to be between 13% and 28% over a five-year period.

There are a number of key factors that influence the premium a specific building can achieve:

Market Location and Demand: In markets with strong environmental awareness and regulations (like London, New York, or Sydney), the premium is often higher. As more corporate tenants set sustainability goals, the demand for certified office space is rapidly outpacing supply, driving prices up.

Certification Type and Level: The two most recognized international standards are LEED (primarily in North America) and BREEAM (prevalent in the UK and Europe). Generally, a higher level of certification (e.g., LEED Platinum or BREEAM Excellent/Outstanding) will command a higher premium than a basic certification.

Building Class: Some studies show that Class B buildings with certification achieve higher relative rent premiums than Class A buildings, likely because certified Class B properties are more scarce.

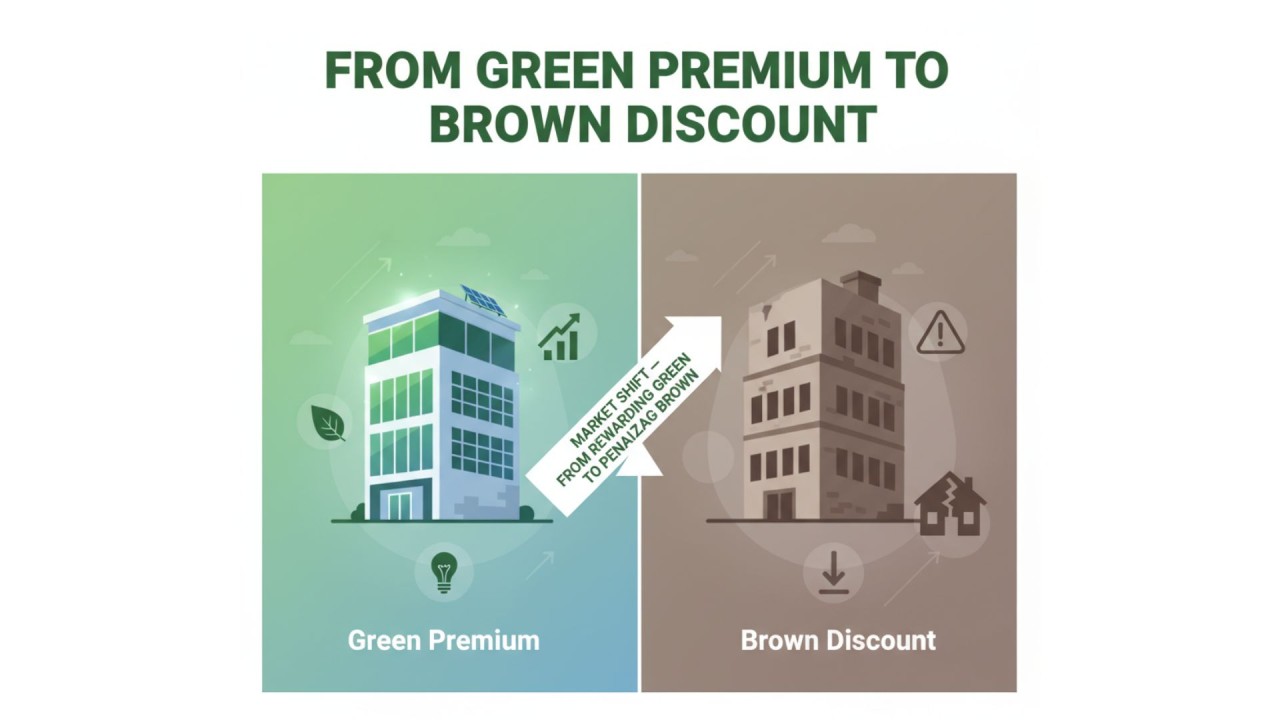

The “Brown Discount”: As green buildings become the norm in certain markets, the dynamic begins to shift as well. Instead of a green premium for certified buildings, non-certified buildings are starting to suffer from a “brown discount”—where they lose value or face rental penalties for inefficiency.

Based on everything already stated, a question remains. Why does this premium exist? The green premium is not an arbitrary number. It is a direct reflection of tangible financial benefits that a valuer can measure, such as:

Lower Operating Cost: For example, LEED-certified buildings achieve energy savings of 25-30% and can reduce maintenance costs by around 20% compared to conventional buildings.

Higher Occupancy Rates: Corporate tenants with ESG commitments prefer certified offices, leading to lower vacancy rates.

Reduced Risk: Certified assets are more resilient to tightening carbon regulations, reputational risks, and climate impacts, making them a safer long-term investment.

While no universal percentage applies across all markets, the evidence is clear: green building certificate translates into a significant and measurable increase in a property’s market value and rental income. More importantly, the market is evolving. What was once a green premium is rapidly becoming a baseline expectation. Investors who fail to adapt may face the opposite effect — the brown discount — as tenants and regulators increasingly penalize buildings that lag behind.