Did you know that green loans — specially designed to support eco-friendly investments — are quietly reshaping Armenia’s sustainable future?

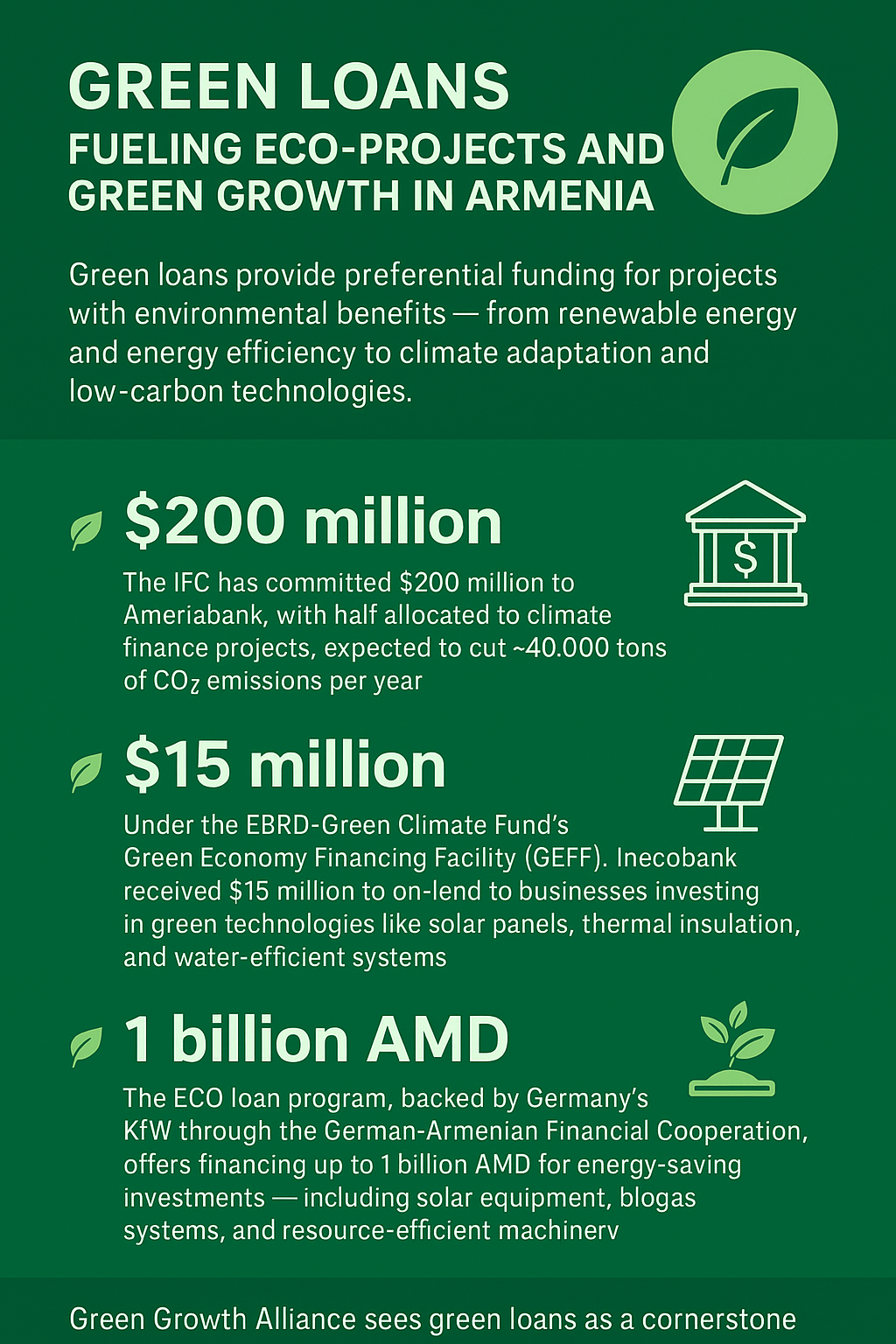

Green loans provide funding for projects with environmental benefits — from renewable energy and energy efficiency to climate adaptation and low-carbon technologies.

In Armenia, several key green financing initiatives are already making their mark:

1️⃣ In January 14, 2025 — The International Finance Corporation (IFC) has committed $200 million to Ameriabank, with half allocated to climate finance projects, expected to cut ~40,000 tons of CO₂ emissions per year — the equivalent of taking 9,000 cars off the road.

2️⃣ In May 14, 2025 — under the EBRD’s Green Climate Fund’s Green Economy Financing Facility (GEFF) framework, Inecobank received $15 million to on-lend to businesses investing in green technologies like solar panels, thermal insulation, and water-efficient systems.

3️⃣ The ECO loan program, backed by Germany’s KfW Bank through the German-Armenian Financial Cooperation, offers financing up to 1 billion AMD for energy-saving investments.

By enabling green tech adoption, they help businesses reduce energy costs, lower emissions, and turn environmental responsibility into a competitive advantage.